The World Needs a Free Market in Silver

(Functioning Markets Solve the Problem and Free Markets Work Best)

Silver Stock Report by Jason Hommel,

September 7th, 2008This may be the most important article that I will ever write in my lifetime, and it may be the most important you will ever read. I don't know if things will ever be as crucial on the world stage as they are today. The world has a choice to head towards increased freedom and prosperity, or towards shortages and misery.

Typically, stories of inflation and hyperinflation are accompanied by stories of food shortages, misery and pain. During some hyperinflations, people are reported to be so desperate to save their currency that they will buy bed pans or piles of horse manure to preserve the value of their wealth. Thank God we can still buy silver, instead!

The price of Rat Meat in Cambodia has increased 400% as investors flee from inflation!

http://news.yahoo.com/s/nm/20080827/od_uk_nm/oukoe_uk_cambodia_rats

Today, there is a world emergency, a world crisis that is being ignored, because silver is a neglected and forgotten metal and industry, and more eyes are on the banking crisis and on the election than on silver.

The silver markets are failing and breaking down. The COMEX fraud of allowing the sale of excessive and unbacked paper futures contracts is destroying the silver market. Too many silver dealers, refiners, and coin shops have relied on the COMEX price to set their own prices, although nothing was for sale and no silver came to market when those prices were set, and so they mostly all ran out of inventory.

If we do not solve the problem of the broken COMEX market, the world will continue to be plagued with shortages that will extend much further than the silver market, and into all other markets. We could end up with desperate food shortages, as investors who cannot find silver may end up purchasing food to protect their money, instead of silver, and if that happens, starvation on a world-wide scale could result. In fact, it has already begun with rising food prices worldwide as investors pour into grains as a result of inflation driving speculators into all commodities.

Price increases push US soy beyond reach of poor:

http://money.aol.com/news/articles/_a/bbdp/price-increases-push-us-soy-beyond-reach/163191

That is the danger of allowing COMEX fraud to continue unopposed. The best way to oppose COMEX fraud and end it, is not through letter writing campaigns to the CFTC, and not through police crackdowns from the SEC, nor from new regulation by Congress.

We don't need to use force to stop evil. We can overcome evil with good. Where the spirit of the Lord is, there is Liberty! We just need to understand, embrace, and create freedom.

And so, rather, the best way to oppose COMEX fraud and end it is to create an alternative free marketplace or free markets where silver can always be more and more freely bought and sold.

An alternative free market will end the fraud faster than you can imagine, much faster than any CFTC investigation, through the profit incentive to buy from one market to sell into another.

Have no fear. The profit incentive, and the ease of the use of the internet, will create the incentives to create that alternative market where our silver will be fairly valued, and freely traded.

Traders rightfully point out that if the COMEX price is fraudulently too low, then people would buy bars at COMEX, and sell into the free market, and make a killing.

After all, you can make much, much more on a 20% mark-up by quickly flipping silver and selling to investors than you can with a 100% mark up selling jewelry, because the jewelry market has slower turnover of product.

Example: If you can make 20% per transaction, and make 12 such transactions per year, only once a month, you can make 792% in a year!

See

http://www.smartmoney.com/compoundcalc/

for the math.

I might not be willing to risk my money to stand for delivery of a COMEX contract, but others will, if there is another market for them to easily sell into.

You could make even more money, 1200% per year, making a 5% profit spread if you bought in one liquid market and sold into another liquid high volume market once a week. Liquidity is key. Liquidity is crucial to the speed of trading, which aids turnover. Silver, by its nature, should always be extremely liquid.

At COMEX, liquidity in silver is thwarted by having a "delivery month" of an unreliable time frame, and not every month is a major delivery month. The Post Office, as dreaded as it is, is far more reliable than COMEX. COMEX also does not ship out silver, but makes you go there to get it.

Given that silver coins are selling at a $3-4 per ounce premium over the spot price, which is about a 30% premium or profit, then makers of silver coins and bars should be able to make huge profits, if they can find silver bars at COMEX prices to turn into coins!

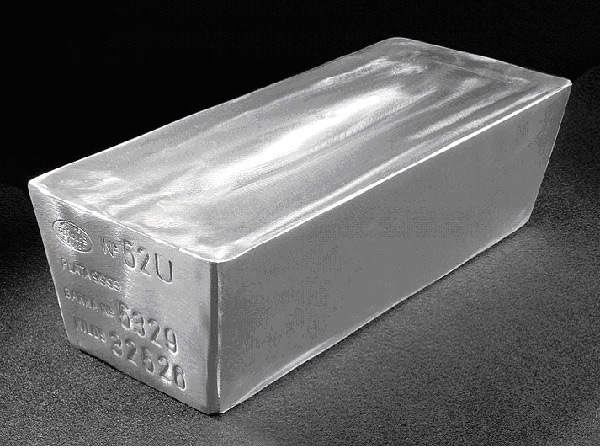

This is how we know 1000 oz. silver bars are in short supply! Perhaps the recent shortage is at least partly a result of this month, September, being a delivery month.

But there's a bigger problem. A free market in silver with high volumes and low spreads does not exist. So, you can't go and buy silver from COMEX, to sell into a non-existent market.

Today, maybe neither market exists!

There are alternatives to COMEX, but none of them has the capacity to pick up the slack and carry the huge volumes of trade, and allow a trusted and reliable form of price discovery to take place.

For example, Fresnillo, the silver refinery in Mexico that refines about 90% of the silver in Mexico, which produces about 80 million ounces of silver per year, ships out 600,000 ounces of silver at a time, in 1000 oz. bars, 30,000 oz. per pallet at a time.

The world needs a market that can handle and service the needs of refiners such as Fresnillo, so they will ship to the free market or at free market prices; instead of to COMEX or to other places at COMEX prices.

Yes, there are the coin shops and online bullion dealers. But investors typically do not want 1000 oz. bars because they are ugly, not standard size, and too heavy at around 70 pounds. APMEX recently had more than 20 for sale for a few days, and they sold out, but that's not a very large volume, and they didn't sell at a much of a premium, only about 35 cents over spot.

Ebay is good because they only allow people to sell what they have, and there is a rating system in place to allow feedback on sellers reputations, and ebay allows competitive bidding to allow an odd form of price discovery to take place.

But ebay is not useful because we often do not see the final auction price at the last minute. And ebay is bad because fees are excessive with fees ranging from 10-15%! That's not a "free market", it's a rather costly market! Also, it is difficult to buy in volume, because there is limited product available. And fraud levels are still too high, and there are additional penalties on sellers. Another drawback to ebay is that there is no aggregation ability to place large orders over multiple auctions of standardized fungible products that are similar enough to be interchangeable. Nor can you use ebay to sell into anyone's standing bid for a standardized form of product. So ebay is mostly a one way market, not a two way market, like an exchange should be.

There is bulliondirect.com. But it, too, suffers from low volume, lack of product availability, product delivery delays, and difficulty of use.

There is craigslist.com. The advantage is that you can connect with people in your local area anonymously for cash to silver transactions, but there is no volume at all.

Goldmoney.com is another site where you can trade. But there is a restrictive trading limit of 1500 ounces of silver per day.

http://support.goldmoney.com/article.php?id=098

And there are other futures markets and exchanges in Tocom, Dubai, Shanghi, and elsewhere, but their volumes are much lower than at the COMEX, and like the COMEX, futures contracts can be created and sold to excess.

In any reasonable money exchange marketplace, gold should also be able to be traded for silver, and silver for gold, without having to move into fiat currencies. So, although my personal focus is on silver, I'm really talking about a new kind of silver and gold market exchange.

The world desperately needs a better silver market, in multiple locations around the world that cannot be shut down by desperate and dying governments that rely on paper money fraud, if the world is to survive the implosion and end of fraudulent futures contract trading.

I strongly believe that the most important features of a free market are to end fraudulent transactions of promises to deliver silver in the future that may not exist.

The fraud must end. That is the most important.

But also, perhaps next most important is to encourage high volumes by providing the best market structure at the lowest possible cost?

Readers, the world needs your help!

There are people who know how to make things happen, who can design specs, set up markets, hire programmers, set up verification systems, set up storage locations, and handle the logistics much better than I can. I'm merely a thinker, a theorist, and a writer. And I have a family, and I'm located in a small town, far away. I'm a horrible manager, and I don't like working with people as I have little patience for those who cannot understand right away, even though it sometimes takes me years to "get it". Anyone who has ever emailed me probably knows I'm "short tempered" that way.

Please give me feedback and share your thoughts, and I'll collect your emails and share your suggestions to inspire those people who are more people oriented and action oriented who can make this happen. What other features are important in the design of the most optimal and most free, free market for silver?

Topics for thought:

Ease of use? - OR - Verification of users?

Elimination of fraud? - OR - A Reliable and successful transaction history?

Standardization of bars? - OR - Verification of bars?

Bid/Ask trading at all hours? - OR - Once per day auction price setting?

Reduced speculation & Reduced leverage? - OR - Fully paid for trading?

Ability to handle small transaction sizes - OR - ability to handle large volumes through high minimum transaction sizes?

There is also the issue of cross border shipping logistics.

I'm doing my best to end world poverty by educating investors.

There may be limited silver, but there is unlimited wealth in silver. It just needs to be unlocked by a higher price that can be discovered by a functioning and honest free market in silver.

Sincerely,